Why the first decision most developers make is wrong

When searching for a development project, a developer's first and arguably most critical decision is the type of product they want to build. This is a crucial first step because different kinds of projects necessitate different site characteristics. If you are looking to develop a High-rise project, you will spend your time screening half-acre or smaller sites in dense urban areas; Mid-rise, you will be looking for several acres in lower-density pockets just outside the central business districts; Garden, and you will be looking for 10-20 acres in suburban areas. In most metro areas, these types of sites are often covered by different brokerage communities, further complicating the process of homogeneously screening opportunities across project types. For these reasons, most developers either choose to specialize in a single product type or are drastically less efficient in their search for and eventual development of projects. In its quest to determine what type of projects to focus on, Ridgeview Development Group studied the data and found that Garden Style projects outperform Mid and High-Rise Projects in every metric relevant to investment performance. Throughout the remainder of this Insight, we will explore how Garden Style projects are superior and why, despite having lower returns, most developers, incorrectly in our opinion, choose to pursue Mid and High-Rise projects anyway.

In assessing what types of projects to focus on, Ridgeview Development Group analyzed several key characteristics across project types; these include Cost Basis, Investment Efficiency, Construction Risk, Operating Efficiency, Vacancy Rates, and Overall Investment Returns.

Cost Basis: A common theme across markets when assessing real estate development projects is that rents typically do not scale with costs. If you double the amount you spend per unit on a project, you usually will not see a doubling in achieved rent and, therefore, will achieve lower returns. The primary driver for this is that most renter demand sits within the low to mid-income bands; as rents increase, the demand for a project decreases. Therefore, common sense states that investment returns should benefit if you can develop a lower-cost project without meaningfully hindering rents. While the winner here may seem obvious, it’s worth noting that Ridgeview’s assessment of historical development projects found that nationally, Garden-Style projects can typically be built at a 63% discount to High-Rise and 30% discount to Mid-Rise on a per unit basis.

Source: Statista

Let’s explore a few reasons why Garden-Style Projects tend to be cheaper:

Repetitive building designs: Utilizing a single residential building design for 6-12 buildings allows for phased construction where any code compliance or design deficiencies are resolved early on during the first building’s construction

Streamlined unit mixes: Minimal site constraints and lower density requirements allow for less complex unit mixes, often offering a single unit type per bedroom count, which leads to greater construction efficiencies

Simplified building codes: Typically, three stories tall, Garden-style projects are regulated by simplified building codes that dramatically reduce life safety equipment requirements and material costs

Cheaper materials: Due to their building codes and structural requirements, significantly cheaper building materials and methods can be utilized

Broader contractor market: Less complex systems and designs allow for a broader market of General Contractors and Subcontractors, leading to a more competitive bidding process

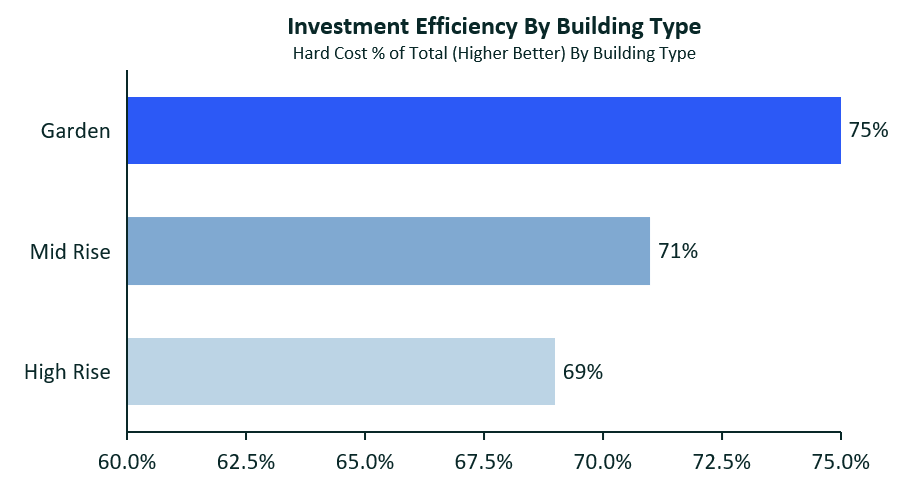

Investment Efficiency: When assessing a real estate development project to invest in, one of the first questions you should be asking yourself is, how much of my capital will be going towards the actual development of the real estate vs. how much will be going towards overhead? In other words, what am I getting for my money? While it’s true that good planning and management help to deliver better returns, overall, the more capital that is spent on hard costs, the more physical real estate is being built, and the higher you will be able to drive rents. When looking at the data, Ridgeview Development Group found that Garden Style projects have a higher investment efficiency, with a larger portion of invested capital going toward physical Real Estate, driving higher returns.

Source: Bloomberg

Let’s explore a few reasons why Garden-Style Projects tend to be more efficient:

Lower design phase costs: Less complex design and reusable residential building designs lead to cheaper architectural, civil, structural, and mechanical design costs

Lower per unit land costs: Lower per unit land costs lead Garden-style projects to allocate 3.6% and 2.6% less of their total budget towards land than Mid-rise and High-rise, respectively

Modest amenities/lower FFE costs: Modest amenity requirements lead to significantly smaller Furniture, Fixture and Equipment budgets

Lower Financing Costs: Lower risk assessments combined with shorter construction periods lead to Garden projects spending 0.6% and 1.3% less of their budgets on financing costs than Mid-rise and High-rise projects, respectively

Construction Risk: Historically, one of the largest drivers of return fluctuation (development projects missing their return targets) is construction risk. Rarely do you hear of a developer who missed deadlines or overspent on pre-development. However, it’s all too common to find developers months behind on project construction or way over budget and have blown through their contingency budgets. Ridgeview Development Group believes that the physical nature of Garden Style projects dramatically reduces construction risk. Let’s explore a few ways how:

Construction Type: Garden-style apartments are typically built of non-fire-treated wood frame structures. Wood frame structures generally are less complex than steal or concrete and are easier and more cost-effective to rework, therefore lowering risk relative to type 1 (concrete) or type 2 (masonry) buildings

Life Safety: Garden-style apartment buildings require significantly less complex life safety systems than Mid-rise or High-rise buildings. Typically, the last thing to be completed, and very specialized and building-specific, life safety systems are responsible for a significant portion of construction delays

MEP: Garden-style apartments can be designed with lower complexity mechanical, electrical, and plumbing requirements. They typically lack building-wide HVAC and water heating systems in exchange for individual unit systems, similar to those in single-family, and have reduced complexity in electrical equipment given the smaller building sizes

Unit Type: Garden-style apartments typically have 3-5 unit types, whereas high-rise and mid-rise projects can have anywhere from 10-25. This reduced unit count means there is a lower chance of design deficiencies being discovered during construction and that sub-contractors become more familiar with each unit design, reducing overall complexity and the risk of as-built errors

Phasing: Garden-style apartments typically have many buildings of the same design. This allows general contractors to phase work, inspections, and unit deliveries building by building. Doing so means that design deviancies or code compliance issues are discovered in the first building, and remedies can be applied proactively to the remaining buildings

Workforce: Labor shortages have been one of the most significant drivers of construction delays in recent years. Because Garden-style apartments use simpler construction types, life safety systems, and MEP designs, a broader pool of qualified labor can build them. As such, the risk of construction delay caused by labor shortage is lower for Garden-style apartments

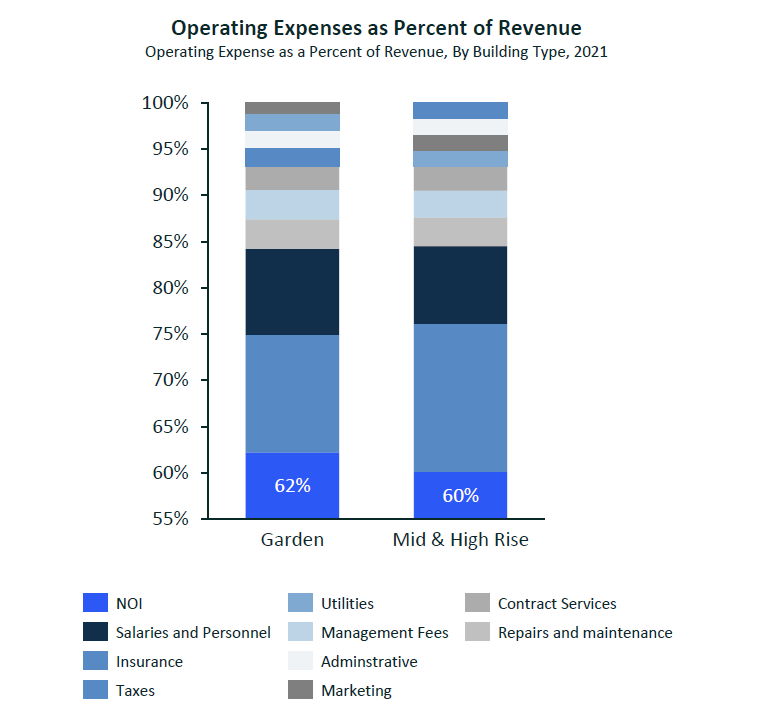

Operating Efficiency: Whether developing or investing in real estate, one of the largest drivers of investment performance is the operating efficiency of the property. The higher the margin, or said differently, the lower the operating costs, the more cash flow is passed through to investors during the holding period. Furthermore, this effect can significantly impact returns during disposition when a slight increase in Net Operating Income can have a major impact on sale value. Unsurprisingly, Ridgeview Development Group found that Garden Style projects tend to spend 2% less revenue towards operating expenses, driving higher NOI margins and higher returns.

Source: 2021 NAA Operating Income Survey

Vacancy: When operating a multi-family, real estate investment property, one of the largest drivers of profitability is vacancy rates. With the majority of operating costs being fixed costs, additional revenue derived from increased occupancy flows straight to the bottom line. Similar to operating efficiency, while increases in occupancy can have a significant impact on returns during disposition when a slight increase in Net Operating Income can have a major impact on sale value. Unsurprisingly, Ridgeview Development Group found that Garden Style properties historically tend to have between 1% and 2% higher occupancy than Mid and High-rise properties, driving higher NOI margins and higher returns. Furthermore, during times of uncertainty, such as the 2020-2021 COVID-19 pandemic, Garden-style properties tended to fare significantly better than more urban Mid and High-Rise properties.

Source: RealPage Axiometrics

Investment Return: Now that we have assessed all of the drivers of development investment returns and found that Garden Style development projects outperform Mid and High-rise projects in every metric, let’s look at how that all adds up. Ridgeview assessed returns over the last ten years across a number of development projects by several of the largest multifamily developers and unsurprisingly found that, on average, Garden-style projects tend to outperform Mid and High-rise projects on a realized gross IRR basis by 12.3% and 18.1% respectively. With the bottom 25% percentile of Garden projects in line on returns with the top 75% percentile of High-Rise projects.

Source: Preqin

Having looked through the data and found that Garden Style projects are both lower risk and have higher returns than Mid and High-rise projects, we were left asking ourselves, why do most developers focus on the latter? While we can’t say for sure what factors are considered in their decision-making process, we can speculate. Here are a few reasons why developers may ignore risk-adjusted returns and focus on Mid and High-rise projects.

Prestige: Many developers are “Real Estate People” who take pride in developing iconic, skyline-changing projects and get excited over the prospect of designing market-leading buildings. This often leads them to put prestige before financial returns

Larger Fees: Higher rent levels typically have higher quality finishes, costing more money. Given fees are often a percentage of project costs, many developers get blinded by the prospect of charging higher fees per project. Ridgeview believes that the lower complexity of affordable options, combined with the higher promote associated with higher returns, should offset this effect but speculates that many developers are short-sighted here

Risk/Return Misconceptions: Firms are typically very entrepreneurially run, with senior people coming up as developers rather than business/management focused. As such, even the largest developers typically don’t look at data on a holistic strategy setting level; rather, they focus opportunistically, project by project. This leads to the common misconception that higher rents must equal higher returns

Higher Cost Discipline: During construction, challenges often arise that can lead to increased costs. For developers, the easy route is to rationalize these costs by saying they will increase product quality and thus achieve higher rents. Building affordable units requires a higher level of cost discipline and construction oversight

Higher Design Oversight: Architects, interior designers, etc. work in a portfolio-driven industry, where being able to show off high-end projects gets them new business or their next job. Therefore, as a developer, designing cost-efficient buildings requires significant additional design oversight

While we can’t speak for other developers at Ridgeview Development Group, our fiduciary responsibility comes first. This is why, given the data presented above, we have chosen to focus our efforts on Garden Style development projects.