America’s affordable housing shortage, and what it means for development returns

In a previous Insight, titled “Why the first decision most developers make is wrong” we discussed why Garden Style apartment projects tend to have significantly higher investment returns and be lower risk than Mid and High-rise projects. Concluding that developers who value their fiduciary responsibility to investors should focus their efforts on Garden Style developments. In this Insight, we would like to expand on our Garden apartment investment theses to explain how, by nature of their lower cost basis, not only are Garden development projects higher returning investments, but they can also help address the growing affordable housing shortage. Thus having the double advantage of providing modern, safe, affordable housing while benefiting from the outsized demand for affordable housing that should provide increased rent growth for years to come.

America’s Affordable Housing Shortage:

Historically, developers across the country have done a reasonably good job of balancing new housing supply with the demand from new households. However, this changed in early 2018 when the growth in new households began to significantly outpace the housing supply. Leaving a cumulative net housing shortage of ~1.5m units as of Q4 2023.

Source: St. Louis FED Economic Research

At the same time, the country was experiencing a housing shortage; rising interest rates led to dramatically increased costs of servicing a mortgage, a larger percentage of locked-in fixed-rate homeowners led to a reluctance to sell homes and a decline in home supply, and the post-COVID demand for up-sizing led to an increase in housing demand as people stopped having roommates. These combined factors drove the cost of home ownership vs. renting to an all-time high, which in return drove higher rents and priced out the lower end of the market.

Source: WSJ, CBRE, Freddie Mac, US Census Bureau, Realtor.com, FHFA

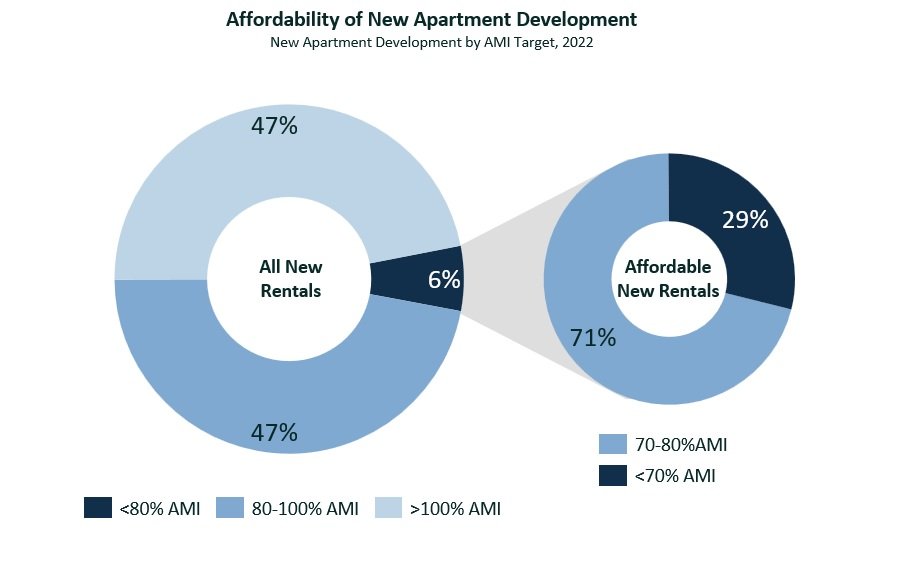

You wouldn’t be blamed for thinking that this uptick in demand for affordable rental housing would drive more developers to build affordable Garden Style apartment projects. But as we discussed in “Why the first decision most developers make is wrong” there are a number of other factors outside demand and returns that push developers to target higher-end projects. In fact, in one study, it was found that less than 6% of new apartment development is targeted at being affordable below 80% of the local area median income (AMI), with only 29% of that 6% (~1.7% overall) targeted at less than 70% of AMI.

Source: CoStar, Root Policy Research

So far, we have learned that the country is facing a housing shortage, at the same time, a number of factors have made the cost of homeownership skyrocket vs the cost of renting, which has pushed people who could typically afford to purchase homes into renting. Subsequently driving up rents and pricing out lower-income renters. While we would expect entrepreneurial developers to fill this uptick in demand for affordable rental product, they haven’t. As such, between 2019 and 2023, we have seen housing place an increasingly severe burden on households in the majority of American cities. With some areas seeing more than a 10% uptick in the number of households spending more than 50% of their income on housing in just four years.

Source: Harvard JCHS

Opportunity for Developers:

While some developers have chosen to focus on other areas, Ridgeview Development Group believes that the significant increase in demand for safe, affordable housing that this affordable housing shortage has caused presents a strong investment opportunity for Garden Style apartment development. The reason being that outsized demand typically drives outsized rent growth and, thus, higher returns. As shown in the chart below from Q2 2023, in areas where the demand/supply ratio is more favorable, higher rent growth is typically observed.

Source: RealPage Market Analytics

Furthermore, we have seen that historically, affordable apartments have seen higher rent growth and less rent volatility over the last ten years.

Source: CBRE research, CBRE Econometric Advisors

With the affordable housing shortage expected to increase and the number of apartments affordable to people at less than 80% AMI expected to drop in some markets from 58% to ~18% between 2019 and 2040, we at Ridgeview believe the demand for affordable apartments will continue to grow and that this increase in demand will drive outsized returns for years to come.

Source: CoStar, Root Policy Research

Notes: (1) Projected future apartment affordability in the Greater Denver Submarket, believed to be representative of most major metro areas