Current state of the commercial real estate debt markets

It's no secret that real estate development projects rely heavily on debt as a financing source, with construction typically being capitalized between 50%-65% from debt and stabilized assets traditionally taking on between 60%-80% loan to value (LTV) loans. It's also no secret that over the last 12+ months, traditional bank lenders have seen increased distress among real estate loans, with small to midsized banks feeling the brunt of the burden. Throughout this insight, we will take a look at the state of the commercial real estate lending industry, the availability of multifamily loans, and how that impacts Ridgeview development projects.

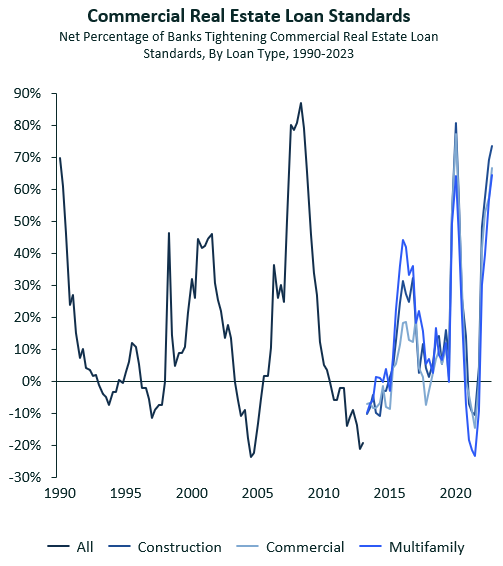

As we exited the COVID-19 era, the state of American cities changed in an unprecedented way. Work-from-home culture has penetrated the majority of businesses, leaving demand for office real estate at an all-time low. Vacancy rates climbed as high as 17% in many major metros, with utilization rates even lower. The companies that retained office space upgraded to Class-A buildings in an attempt to draw employees back to work, and owners of lower-quality office assets found themselves unable to afford debt service coverage and, at increasingly high rates, handing the keys back to the banks. This sparked a panic among many small to mid-sized banks in early to mid-2023, causing the majority of banks measured by the Federal Reserve Senior Loan Officer Survey to report tightening Commercial Real Estate Loan Standards.

Source: US Federal Reserve Senior Loan Office Survey

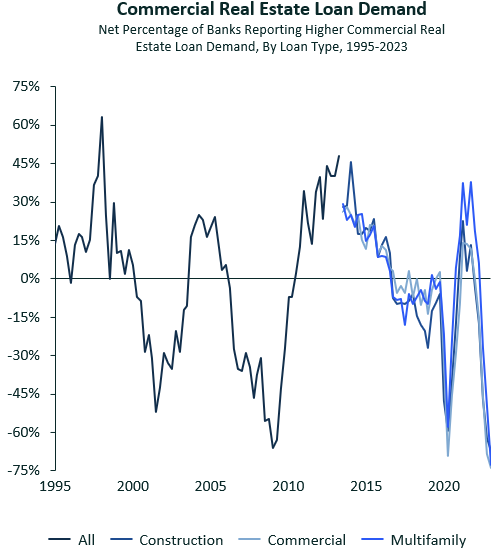

This tightening in standards, combined with an increase in underwriting targets for new development and investment projects associated with the increased risk-free rate, led to a drop in demand for new real estate loans.

Source: US Federal Reserve Senior Loan Office Survey

The combination of these two factors has led to the first half of 2023 reporting the lowest commercial real estate debt issuance volumes in recent history.

Source: US Federal Reserve Senior Loan Office Survey

While at an aggrege level, as presented above, these numbers may seem concerning to anyone looking to serve as the equity investor in a new real estate development project, it's worth taking a more nuanced look at how these changes affect individual asset classes. The reason this breakdown is helpful is that while office investments struggled in the post-COVID era, multifamily investments benefited from one of the largest run-ups in rents in recent memory. As such, when surveyed about which sectors they expected to see an increase in defaults in, loan officers reported multifamily as the least likely to see increasing rates of defaults into 2024.

Source: CBRE Economic Advisors

As such, with multifamily real estate loans showing the lowest perceived increase in risk, it's no surprise that the risk premium charged in multifamily debt, as measured by rate spreads, has remained consistent throughout the recent rising rate period.

Source: FRED

Given that spreads have remained consistent, it's not unreasonable to expect that this trend will continue. Thus, if the FED begins to lower rates, as the market clearly expects it will, Multifamily Real Estate loan rates should start to return to historical levels.

With that in mind, two questions arise. First, how long will it likely take for commercial real estate loan volumes to return to historic levels, and second, what impact will tightened lending standards have on Garden Style Development Project Returns?

As for timing, the best guess we can make is by looking at historical periods of tightening. For example, during the 2007-2008 tightening, it took 35 months for volumes to bottom and another 30 months for volumes to reach historic highs.

With current volumes having peaked in March 2022, if historical patterns continue, markets should start to rebound shortly.

However, in the scenario where it remains difficult to source loans for longer, investors should take solace in knowing that because of their shorter construction timelines and phased unit deliveries, Garden-style development projects are much less sensitive to construction debt terms than other real estate development types.